Why Are Patients Being Billed for “Free” Preventive Health Care?

The 2010 Affordable Care Act (ACA) deemed certain types of preventive services to be “essential health benefits” that should be free. Yet this potentially lifesaving care often results in unexpected patient bills sent by what a BenefitsPRO article calls “America’s ever-creative medical billing juggernaut.”

The article highlights several instances of patients receiving surprise (and often illegal) invoices:

- Additional bills of $1,000 for the radiologist’s reading fee and $236 for equipment and facility charges for “free” mammograms

- A $450 bill to biopsy a polyp found during a “free” colonoscopy

- A $111 “consultation” charge added to a no-cost preventive care visit because the patient responded positively to a question about “additional health concerns”

The medical establishment continues to erode the ACA’s guarantees of no-cost preventive care by exploiting gray areas of the law and redefining which aspects of a medical encounter it covers. When patients are blindsided by bills for care that should be free, it discourages them from seeking both preventive screenings and needed follow-up care, threatening their health and productivity in the workforce.

“The stories KFF Health News and NPR receive are likely just the tip of an iceberg. And while each bill might be relatively small compared with the stunning $10,000 hospital bills that have become all too familiar in the United States, the sorry consequences are manifold. Patients pay bills they do not owe, depriving them of cash they could use elsewhere. If they can’t pay, those bills might end up with debt-collection agencies and, ultimately, harm their credit score.”

Employers can combat these abuses with a modern health plan and exceptional concierge support from advocates who will defend members against such practices. This ensures members get all of the free preventive care they deserve without being charged for it, as well as help navigating a challenging healthcare system.

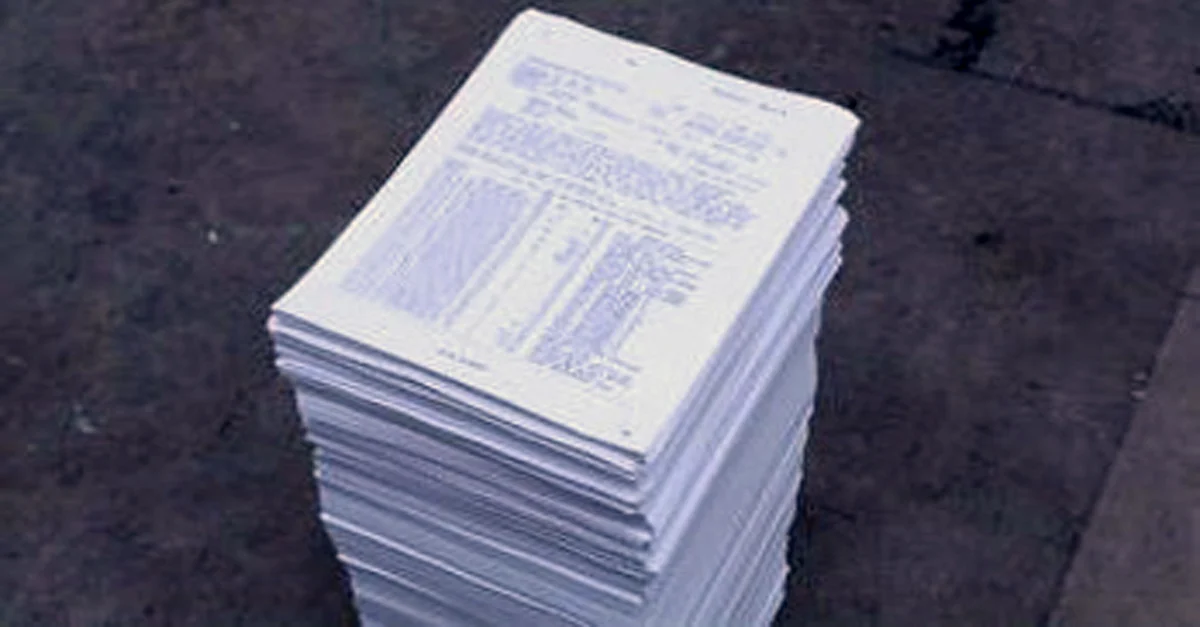

This installation-based work is a neat pile of 7,865 documents from 2012 to 2015 that includes bills for medical treatments, medical records, and care plans with their accompanying costs. Had all communications with the bureaucracy of the healthcare system to date been included, the pile would have fallen over.

This installation-based work is a neat pile of 7,865 documents from 2012 to 2015 that includes bills for medical treatments, medical records, and care plans with their accompanying costs. Had all communications with the bureaucracy of the healthcare system to date been included, the pile would have fallen over. Note the piece of paper on top of the pile: a partial bill from the day after the accident in excess of $144,000 for various surgical interventions on Barker’s spinal cord.

Note the piece of paper on top of the pile: a partial bill from the day after the accident in excess of $144,000 for various surgical interventions on Barker’s spinal cord.