3 min

Employer health plan sponsors who stay with outdated, status quo insurance carriers perpetuate practices that benefit the insurer instead of the insured. Author-surgeon Dr. Marty Makary asserts that health plan freedom only comes into reach when employers abandon the chronic condition of “groupthink.”

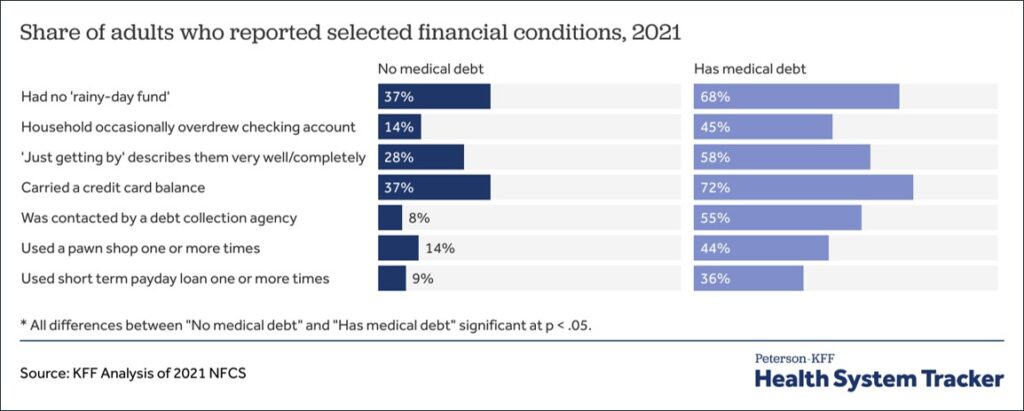

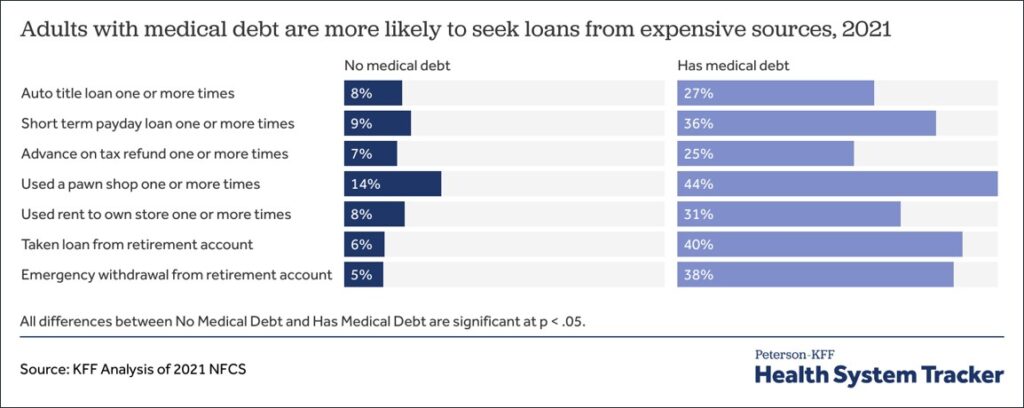

Continued fealty to legacy insurance plans only deepens the cumulative burdens of rising costs, negligible cost controls, lack of transparency and data access, poor member support and financial trauma, and employer fiduciary risk. Employers can, and should, do better.

Commit to an Intentional Plan of Action

Many employers are held hostage by the belief that they have only two choices:

- Maintaining the status quo with an ever more costly legacy insurance carrier, or

- Taking a big leap to alternative plans.

This is an illusion. By implementing an intentional, multi-year strategy with manageable plan changes and employee choice, employers can gain year-over-year control and freedom on a realistic timeline.

Most important to escaping groupthink is leaving the restrictions and disadvantages of legacy insurance carriers behind. Employers can begin by moving to a conflict-free, modern health plan administrator that offers advanced tools and controls for delivering a health plan that is incrementally less costly and offers better, more compassionate coverage. This can be accomplished successfully with clear communications that ensure company leaders and employees understand the inherent benefits.

Year 1 | Savings 10%+

Move to a Modern Health Plan Administrator

Game Plan | Achieve full access to claims data, complete cost transparency, and 10%+ savings. (If fully-insured, move to a self-funded or level-funded plan finance methodology.)

- Implement a national PPO or regional preferred provider network for initial comfort

- Deliver an advanced cost-plus, full pass-through Rx plan with built-in member financial assistance for 40%+ savings

- Add nationwide, preferred surgery bundled contracting that waives member costs for 50%+ savings

- Offer virtual care for physical and behavioral medicine at no cost to members

- Gain better out-of-network claim pricing and cost control

- Provide concierge member support and advocacy

Year 2 | Savings 20%+

Increase Cost Control and Plan Freedom

Game Plan | Build on Year 1 by adding a plan that uses advanced fintech for medical claims reimbursement instead of poorly performing PPO network contracts. This will significantly reduce employer costs and fiduciary risk while increasing employee disposable income and limiting out-of-pocket financial exposure.

- Continue offering the Year 1 PPO plan with its cost control components, member cost-waived benefits, and concierge support

- At enrollment, give employees the option to choose an open-access provider-choice plan that is less costly and provides better coverage. The open access plan uses Fair Market Payment reimbursement for hospital/facility claims and a nationwide physician network, resulting in 30%+ savings over the PPO plan (members are never out-of-network on this plan)

- Realize lower stop-loss premiums and reduced chance of spec claims

- Reduce medical cost trend

Year 3 | Savings 30%+

Optimize Savings

Game Plan | Build on Year 2 savings by increasing enrollment in the open-access plan and expanding use of the preferred surgery program.

- Enrollment in the open-access plan will increase naturally in response to its lower payroll contribution and out-of-pocket cost

- Add incentives to boost open-access plan enrollment; increase the PPO plan buy-up

- Realize further reduction of stop-loss premiums and chance of spec claims, and even lower medical cost trend as enrollment shifts from PPO to the open-access plan

In outlying years, the PPO plan might be grandfathered, offered only to a subset of employees, or removed altogether.

For larger employers, taking a “slice approach” can work well starting in the first year. In this scenario, a legacy insurance carrier is left in place and a modern plan administrator is secured separately to give employees access to the open-access plan and enhanced member benefits. A modern administrator can deploy a cost-plus, fully transparent, pass-through Rx plan to the entire population.

Similar to Years 2 and 3 above, enrollment will naturally migrate year-over-year from the legacy PPO plan to the open-access plan for growing savings. The legacy PPO plan can be grandfathered or removed at some point.

Gain a Competitive Advantage

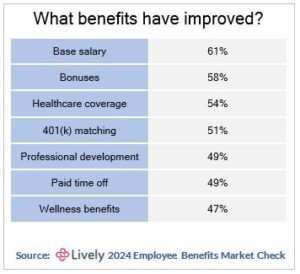

Employers often share the incremental savings realized with a modern health plan administrator with employees by improving retirement and other benefits. This is an excellent strategy for attracting and retaining talent to gain additional advantage in a competitive marketplace.

Never leave to tomorrow that which you can do today. ~ Benjamin Franklin