3 minTechnology leaders and top executives from US hospitals and health systems met recently to focus on healthcare affordability and transforming the patient financial experience. Although many good ideas were generated, the definition and expectation of affordability clearly varies by stakeholder.

Participants in the leadership summit acknowledged that “healthcare in the U.S. is notoriously expensive, including for many people covered by insurance — a reality underscored by the role medical debt plays in more than 60 percent of bankruptcies.” Yet for these constituents, affordability means “enlightened” payment plans that “focus on maximizing the repayment success of the patient.” In other words, let’s improve the odds of the patient paying a bill that is outrageously and unnecessarily high.

The Rapid Rise of Medical Credit Cards

The healthcare industry is increasing its use of technology to improve what it calls the “patient financial experience.” Direct-to-provider payment plans are still the norm, but they are rapidly being replaced by medical credit cards whose lines of credit roughly equal the amount of the patient’s bill.

Research for an article in Crain’s Chicago Business revealed that Synchrony Financial, one of the largest issuers of medical credit cards, reported a 50% increase in purchase volume (from $8 to nearly $12 billion) from 2015 to 2021. The author predicts that it’s just a matter of time before medical credit cards overtake payment plans as the preferred financing method. But preferred by whom?

Hospitals love them because they get paid up front and incur lower transaction fees: a single swipe for a one-time payment vs. 60 swipes for a five-year payment plan. These cards are also promoted (with training provided by the card issuers) by dentists, cosmetic surgeons, and providers whose charges are out of pocket or subject to high deductibles. Even veterinarians are in on the game.

So while hospitals and providers clear outstanding charges from their books, their alliance with medical credit card companies pushes patients into a debt vehicle that’s not in their best interest. The ethics get murkier for nonprofit hospitals who should be providing acceptable levels of free care and services to the community in exchange for substantial tax relief.

Do Patients Benefit from Medical Credit Cards?

Patient reaction to medical credit cards is decidedly mixed. While some appreciate the convenience, others feel they were preyed upon or misled about the terms of their debt, specifically the no-interest introductory period and when interest charges begin accruing. Patients report being pushed to open an account during point of care, including in the emergency room or at discharge.

Kristen Schell, who was profiled in the Crain’s article, says she was pressured into charging urgent gall bladder surgery to a medical credit card, despite being in the financial field for 15 years and “knowing better” that it was not prudent.

Consumer credit experts say medical credit cards should be the last resort for paying a large medical bill. Interest rates are higher: CareCredit is close to 27% while regular credit cards average 19% to 20%. And once medical debt hits a credit card of any kind, it is indistinguishable from consumer debt.

This is a very important consideration for anyone supposedly concerned about the patient financial experience. Consumers rejoiced when the three major credit reporting agencies agreed to remove medical debt from credit reports. However, this only applies to money owed directly to a hospital, care provider, or collection agency. It does not apply to medical debt on any type of credit card. Once charged, it’s just a massive amount of debt in the patient’s credit history that’s viewed less favorably by credit card bureaus.

Transparency and True Affordability

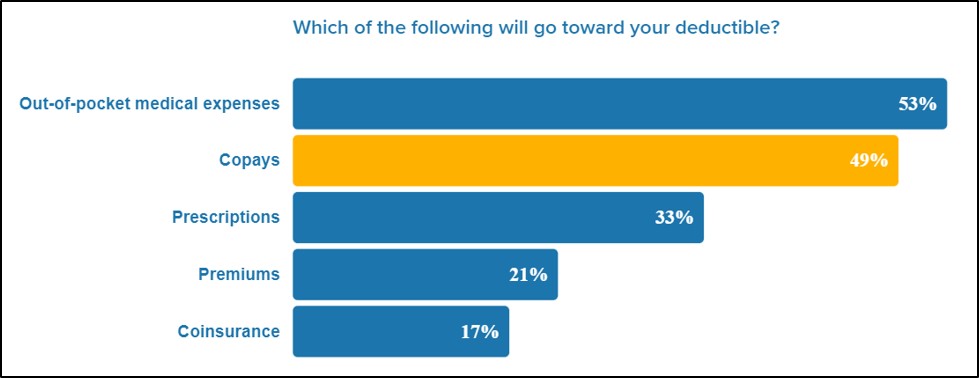

The most encouraging outcome of the leadership summit was a push toward price transparency. Participants acknowledged that “patients still have surprisingly little visibility into what they owe, why they owe it, and how they can pay for it in a way that fits within their budgets.” Additionally, patients “rarely have an opportunity to inform themselves what a consultation, a lab test or an intervention will cost them.”

Technology and artificial intelligence chat bots are being touted as mechanisms to digitize and improve the patient financial experience. And while the technology may be ready, the industry is not. An executive from a Chicago-based health system made the following observation.

“Organizations are putting their prices out there and patients are looking at quality and at what it might cost them, but the problem is they don’t understand the full cost because there’s all this back work with payers about what their true out-of-pocket will be.” In reality, better payment predictive analytics are needed for these efforts to have any real value to consumers.

From a patient perspective, knowing real and accurate costs in advance doesn’t necessarily make them reasonable or affordable, but such transparency is a step in the right direction in that it supports better financial decision making when it comes to health care.

Helping Employees Navigate the System

Employers should consider these two highly effective ways to help protect the financial and health interests of their employees.

- Improve financial literacy through direct education and a compassionate, member-focused health plan that unburdens plan administrators by offering unlimited access to personalized support services during open enrollment and beyond.

- Implement a next-generation employee health plan designed around accountability, transparency, cost-containment and guaranteed savings that prioritizes employer and member needs over those of the healthcare industry.