Employers take great care to choose the best possible health plan for their members. But to get value from their plan, employees must understand common health insurance terms to make sound health care decisions. A recent study shows how a lack of literacy is resulting in confusion and higher costs.

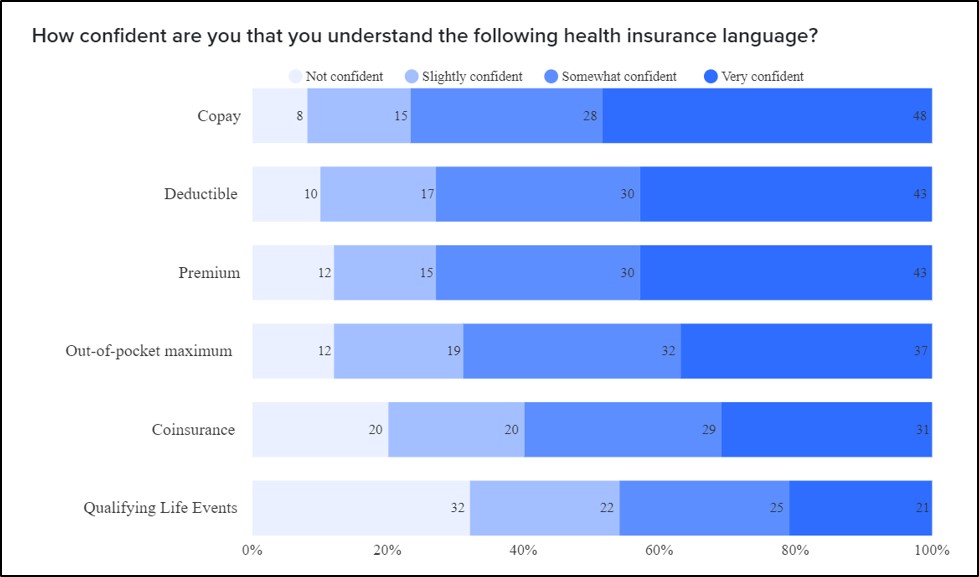

The 2022 health insurance literacy survey published by HealthCare.com asked respondents how well they understood specific health insurance language. The results show “bewilderment over a wide range of health insurance terms and how health insurance functions in the United States.”

Source: Health Insurance Literacy Survey 2022

Despite these varying degrees of confidence, it’s clear that respondents don’t correctly understand how things work.

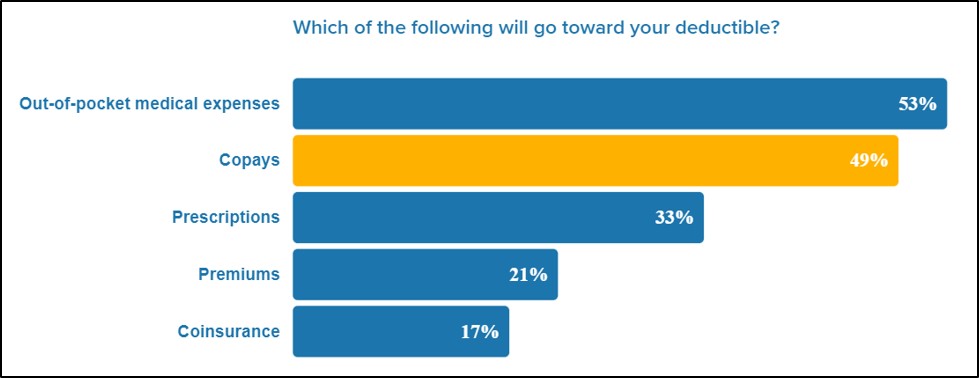

For example, “copay” ranks as the best understood of all the health insurance terms presented. And yet half of all respondents erroneously “believe that copays count toward deductibles when they generally do not.”

Source: Health Insurance Literacy Survey 2022

Additionally, “understanding the meaning of “in-network” is crucial to not getting socked by unexpected health insurance bills. But 4 in 10 respondents (41%) were unable to select the correct option” among four choices to describe its meaning: “See only doctors who are contracted with a carrier associated with your policy.”

As a result, “1 in 4 Americans (26%) say lack of health insurance understanding caused them to receive a higher than expected medical bill.”

Strategies for Empowerment

Employers are ideally positioned to bring clarity to the healthcare conversation and help employees avoid surprise medical bills due to misunderstandings. Here are several strategies that can help members (and employers) in significant ways.

- Expand current financial education programs to include health insurance education. Human Resources and/or plan administrators can create custom resources that meet the specific needs of their workforce and reinforce this information during open enrollment.

- Implement a compassionate, member-focused health plan that unburdens plan administrators by offering unlimited access to personalized support services during open enrollment and beyond. Services should combine member assistance with claims, unexpected bills, and providers, with education on plan features and guidance navigating the healthcare system.

- Choose an open access plan that eliminates confusion about network providers and the potential for high or unexpected medical bills.

- Avoid legacy insurance carrier plans that have strict networks as well as reference-based pricing (RBP) plans, which are adversarial with providers. Payment under RBP plans is considered unfair, and providers often bill patients for the balance of what they thought they should have been paid. Instead, consider a next-generation plan that uses Fair Market Payment™ (FMP) that is equitable for providers, employers, and plan members while saving significantly over legacy insurance plans.

Everyone benefits when employees understand health insurance language and have a simpler, cost-saving, open access plan with better member support.