2 minTwenty years ago, nearly two-thirds of doctors were independent practitioners. Today, only one-quarter remain independent. This mass exodus is being driven by financial pressures, marketplace competition, and the politics of health care. Which begs the question: where have all the doctors gone?

They’re still here… they’ve just switched from being employers to employees. Research by the Physicians Advocacy Institute reveals that by the end of 2021, 52.1% of physicians were employed by hospitals and health systems and another 21.8% were employed by corporate entities such as health insurance and private equity firms.

This is not good news for consumers. Health systems, which are aggregating unchecked across the country, buy and control doctors in order to capture and control more revenue. This is done under the guise of “integration efficiencies.” However, anyone who’s had the misfortune to be a patient can attest to the inefficiency, duplication, miscommunication, and unpleasant billing surprises within these mega systems.

Health systems routinely buy and employ primary care physicians (PCPs) and press these doctors for high volume patient throughput. This leaves mere minutes for most PCP visits and drives more tests and procedures. It also increases costs and maximizes revenue generation for the health system.

Direct Care or Referral?

It gets worse. To maintain this level of throughput, PCPs employed by health systems are required to refer patients to specialists and outpatient facilities within their vertical system, further generating revenue while limiting choice for patients and doctors.

These PCPs are practicing well below their licensure capability. Family, internal, and general medicine physicians are well trained to care for most acute illnesses and manage the most prevalent chronic conditions when patients don’t have extenuating circumstances. Try getting an IV, stitches, a mole or skin tag removed, or a simple fracture set in a PCP office today.

Twenty years ago, less than five percent of PCP visits resulted in a referral to a specialist. The rate of referrals to specialists has more than tripled today.

A New Model for Independent Physicians

Our health care system needs more Direct Primary Care (DPC) physicians who maintain their independence from hospitals, health systems, and corporate employers. DPCs can provide a much wider array of care and when necessary, can refer to lower cost, higher quality independent specialists.

Some DPCs have joined accountable care organizations and adopted patient-centered, medical home models. Nearly 24% are considering ancillary or subscription-based services to benefit their patients.

These doctors generally charge a monthly fixed fee that covers most of the care that the average patient and family will need, including telemedicine, annual checkups, basic blood work, urgent care, chronic condition care, medication management, and more, all without insurance paperwork and extra cost.

This disturbing trend reinforces the industry emphasis on generating profit vs. helping practitioners provide optimal health care. The unfortunate result is that physician and patient choice will continue to erode while costs rise and quality of care declines.

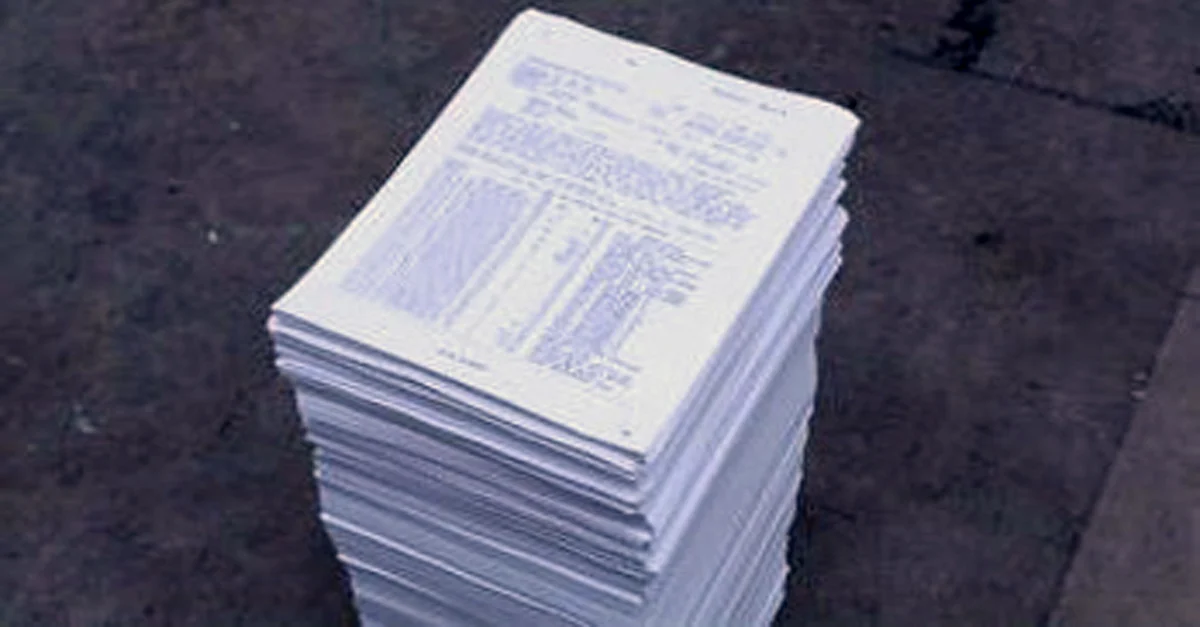

This installation-based work is a neat pile of 7,865 documents from 2012 to 2015 that includes bills for medical treatments, medical records, and care plans with their accompanying costs. Had all communications with the bureaucracy of the healthcare system to date been included, the pile would have fallen over.

This installation-based work is a neat pile of 7,865 documents from 2012 to 2015 that includes bills for medical treatments, medical records, and care plans with their accompanying costs. Had all communications with the bureaucracy of the healthcare system to date been included, the pile would have fallen over. Note the piece of paper on top of the pile: a partial bill from the day after the accident in excess of $144,000 for various surgical interventions on Barker’s spinal cord.

Note the piece of paper on top of the pile: a partial bill from the day after the accident in excess of $144,000 for various surgical interventions on Barker’s spinal cord.