2 minAmerica… the land of the free and the home of the world’s highest health care costs and lowest life expectancy. While you may be familiar with such global comparisons, you may be surprised by the wide disparities in health care quality, affordability, and access, between and even within our states.

The State of Our Health Care

A recent WalletHub study ranked the best and worst states for health care based on these and other criteria including infant mortality rate, doctors and dentists per capita, and the number of adults who have not seen a doctor or dentist in two years. The results are alarming, and the challenge is daunting.

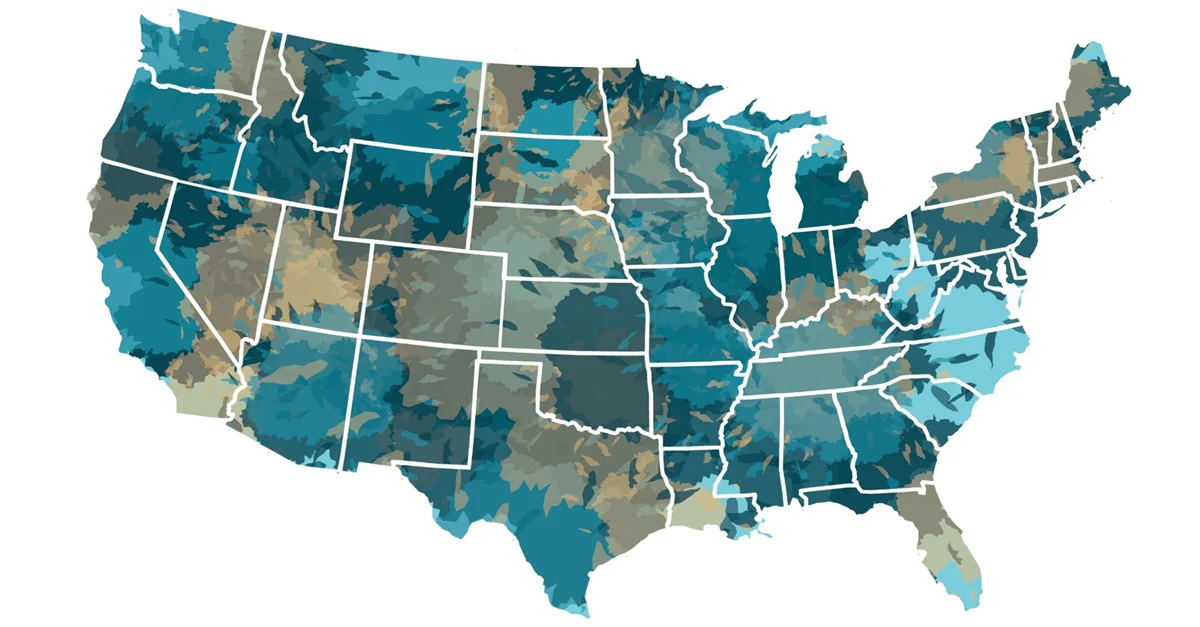

The study includes an interactive table that can be sorted by rank, cost, access, and outcomes. The top two performers are Minnesota and Rhode Island, which are among the top 10 in all four categories. In three out of four categories are Colorado, Connecticut, Maryland, Massachusetts, and Vermont.

Results at the other end of the spectrum are more nuanced. Massachusetts, for example, has high costs but ranks #1 in access and outcomes. Others, like Alabama, Alaska, Louisiana, Oklahoma, and Texas, rate the most poorly in three out of four categories.

Shrinking Access to Maternity Care

While the WalletHub study focused on health care in general, the March of Dimes dug deeper into maternity care. This is especially important because in poorly rated states, there is a direct relationship to high infant mortality rates.

The March of Dimes study identified what it calls “maternity care deserts.” These locations are defined as “any county without a hospital or birth center offering obstetric care and without any obstetric providers.” Obstetric providers include obstetrician-gynecologists, certified nurse midwives, and certified midwives.

It’s hard to imagine that nearly 7 million American women of childbearing age now live in a county with limited or no maternity care services. One-third of U.S. counties, more than half of which are rural, are now maternity deserts. And that number is growing as local and regional hospitals get gobbled up by large hospital systems.

Employers can take an active role in mitigating the nation’s healthcare mess, at the local and individual levels, by choosing an integrated employee health plan with national coverage. It’s best to seek out a next-generation health plan designed specifically to reduce overspending while improving access to quality health care, regardless of location.

Given the difficulty navigating our broken healthcare system, a preferred employee health plan should also include high levels of member support. From answering questions to locating qualified providers, members deserve personalized assistance to get the best care at the lowest cost.