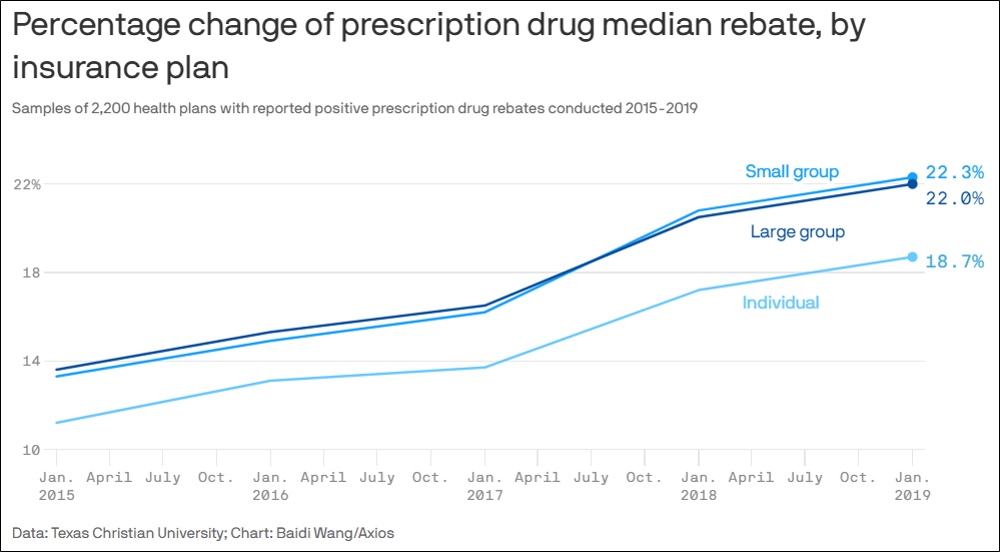

Who Benefits the Most from Rising Drug Rebates? It’s Not Patients.

A study published in JAMA Health Forum reveals that pre- and post-sale rebates from prescription drug manufacturers to commercial health plan sponsors are steadily increasing. Far from reducing out-of-pocket expenses for patients, this convoluted backroom strategy actually makes things worse.

The study succinctly describes how this complex dynamic negatively affects members. (The bold emphasis is ours.)

“Prescription drug manufacturers routinely offer post-sale rebates to pharmacy benefit managers (PBMs) and health insurance plans. While drug rebates can reduce plans’ net costs, rebates do not reduce patients’ cost sharing, which is usually based on pre-rebate list prices set by drug companies. Drug rebates can incentivize drug manufacturers to inflate list prices and PBMs to distort drug formularies to favor high list price and high rebate therapies.”

This can also create equity issues for consumers buying individual plans as well as members covered by an employee health plan.

A related Axios article quotes Ge Bai, accounting professor at Johns Hopkins Carey Business School and one of the authors of the study, as saying, “We have the sick people paying more than their fair share for the drug and the rebate goes back to the plan to reduce premiums for the healthy.”

To build a better formulary, it’s best not to include drugs that are not supported by sound comparative effectiveness research. Follow evidence-based clinical guidelines for prior-authorization of drugs and step-therapy to use less expensive, equally effective medicines first.